|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding the Negatives of Filing Bankruptcy: A Comprehensive Guide

Filing for bankruptcy is often seen as a last resort for individuals facing overwhelming debt. While it can offer relief and a fresh start, it's important to understand the potential downsides. This guide explores various aspects of filing bankruptcy, focusing on its negative implications.

Impact on Credit Score

One of the most significant drawbacks of filing bankruptcy is its impact on your credit score. A bankruptcy filing can remain on your credit report for up to 10 years, severely affecting your ability to secure loans and credit in the future.

Long-Term Financial Consequences

The long-term financial consequences of a damaged credit score can include higher interest rates and increased difficulty in obtaining housing or employment. It's crucial to weigh these factors when considering bankruptcy.

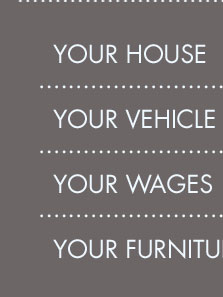

Loss of Property

Depending on the type of bankruptcy filed, you may be required to liquidate assets. This can mean losing personal property, such as cars or valuable items, to repay creditors.

Chapter 7 vs. Chapter 13

In a chapter 13 bankruptcy calculator scenario, you may be able to keep your property while repaying debts over time. However, chapter 7 often involves asset liquidation, which can be more detrimental.

Public Record Implications

Bankruptcy filings are public records, meaning your financial situation becomes accessible to the public. This can be embarrassing and potentially damaging to personal and professional relationships.

Stigma and Emotional Impact

The stigma associated with bankruptcy can lead to feelings of failure and stress, impacting mental health and personal relationships.

Cost of Filing

Filing for bankruptcy isn't free. There are legal fees, court costs, and potential trustee expenses involved. Exploring the chapter 13 bankruptcy cost can provide insight into these financial considerations.

- Attorney Fees

- Court Filing Fees

- Trustee Fees

Alternatives to Bankruptcy

Before opting for bankruptcy, consider alternatives like debt consolidation or credit counseling. These options might offer financial relief without the negative implications associated with bankruptcy.

FAQs on the Negatives of Filing Bankruptcy

How does bankruptcy affect future credit opportunities?

Bankruptcy can significantly damage your credit score, making it difficult to secure loans or credit cards. Lenders may view you as a high-risk borrower, resulting in higher interest rates.

Can I keep any property after filing for bankruptcy?

In Chapter 13 bankruptcy, you might retain assets while repaying debts. However, Chapter 7 could require liquidating valuable items, making it critical to understand each option's implications.

What is the emotional impact of filing bankruptcy?

The emotional impact can be significant, leading to stress and feelings of failure due to the public nature and stigma of bankruptcy. It's important to consider these factors alongside financial ones.

Pros of Filing for Bankruptcy: Debt Relief, Protection of Assets, Improved Financial Management, Opportunity for Rebuilding Credit.

Negative Impacts of Bankruptcy - Your credit will be shot. Anyone considering bankruptcy needs to keep in mind that their credit reports and credit score will ...

The main cons to Chapter 7 bankruptcy are that most secured debts won't be erased, you may lose nonexempt property, and your credit score will ...

![]()